What is a Profit and Loss Statement? Your Business Financial Report Card

A Profit and Loss Statement (P&L) is one of the most important financial documents for any business owner. It's your financial report card that shows whether your business is making money, losing money, or breaking even. Understanding your P&L is crucial for making informed business decisions.

What is a Profit and Loss Statement?

A Profit and Loss Statement, also called an Income Statement, summarizes your business's revenues, costs, and expenses over a specific period (monthly, quarterly, or annually). It shows your bottom line – literally and figuratively.

Simple Purpose: To answer the question "Did we make money or lose money during this period?"

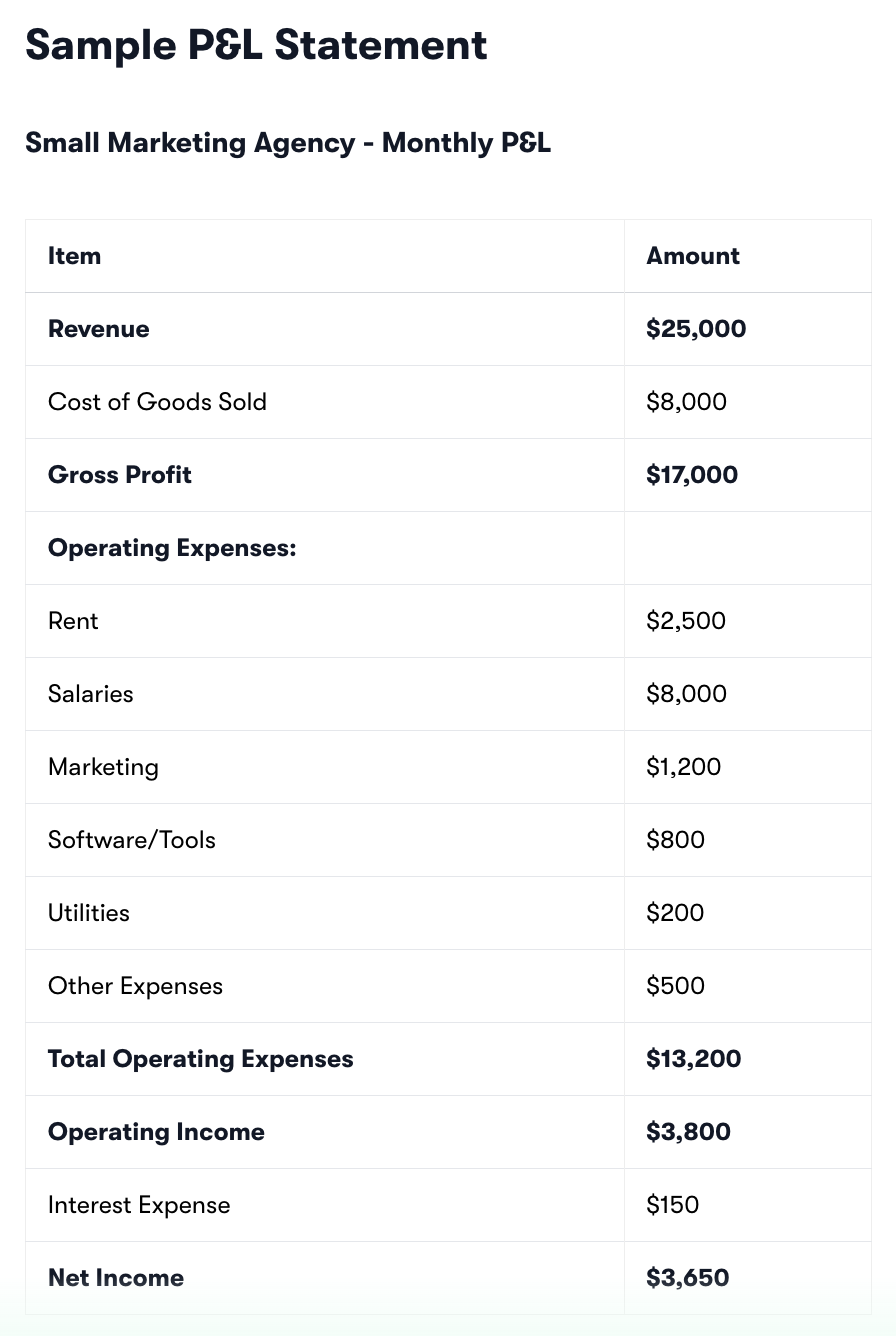

Key Components of a P&L Statement

1. Revenue (Top Line)

Total sales from products or services

Also called gross sales or turnover

The starting point of your P&L

Direct costs of producing your products or services

Materials, direct labor, manufacturing costs

Variable costs that change with sales volume

3. Gross Profit

Revenue minus COGS

Shows profitability before operating expenses

Formula: Gross Profit = Revenue - COGS

4. Operating Expenses

Costs of running your business day-to-day

Rent, salaries, marketing, utilities, insurance

Both fixed and variable operating costs

5. Operating Income (EBITDA)

Gross profit minus operating expenses

Shows profit from core business operations

Formula: Operating Income = Gross Profit - Operating Expenses

6. Other Income and Expenses

Interest income or expenses

One-time gains or losses

Non-operating financial items

7. Net Income (Bottom Line)

Final profit or loss after all expenses

What you actually made or lost

Formula: Net Income = Operating Income - Other Expenses + Other Income

P&L vs. Other Financial Statements

P&L Statement:

Shows profitability over time

Focuses on revenue and expenses

Measures performance

Balance Sheet:

Shows financial position at a point in time

Lists assets, liabilities, and equity

Measures financial health

Cash Flow Statement:

Shows actual cash movement

Tracks cash in and cash out

Measures liquidity

Why P&L Statements Matter

1. Track Business Performance

See if you're profitable month over month

Identify trends and patterns

Measure growth or decline

2. Make Informed Decisions

Where to cut costs

When to invest in growth

Which products/services are most profitable

3. Secure Funding

Banks and investors require P&L statements

Shows business viability

Demonstrates financial management

4. Tax Preparation

Essential for business tax filing

Tracks deductible expenses

Calculates taxable income

5. Set Realistic Goals

Base future projections on historical data

Set achievable revenue targets

Plan expense budgets

How to Analyze Your P&L

Key Ratios to Calculate:

Gross Profit Margin: (Gross Profit ÷ Revenue) × 100

Shows efficiency of core operations

Operating Margin: (Operating Income ÷ Revenue) × 100

Indicates operational efficiency

Net Profit Margin: (Net Income ÷ Revenue) × 100

Shows overall profitability

Red Flags to Watch:

Declining gross margins

Rising expenses faster than revenue

Negative net income for multiple periods

Irregular expense spikes

Common P&L Mistakes

Not preparing statements regularly

Mixing personal and business expenses

Ignoring small expenses that add up

Not categorizing expenses properly

Focusing only on revenue, not profit

Not comparing to previous periods

How to Improve Your P&L

Increase Revenue:

Raise prices strategically

Add new revenue streams

Improve marketing effectiveness

Increase customer retention

Reduce COGS:

Negotiate better supplier terms

Improve operational efficiency

Reduce waste and spoilage

Control Operating Expenses:

Review all recurring expenses

Eliminate unnecessary costs

Negotiate better rates for services

Automate processes to reduce labor costs

P&L Best Practices

Prepare monthly P&L statements

Compare to previous periods

Benchmark against industry standards

Use accounting software for accuracy

Review with your accountant regularly

Focus on trends, not just single months

The Bottom Line

Your Profit and Loss Statement is your business's financial scorecard. It tells you whether your business model is working and where you need to focus your attention. Regular P&L analysis helps you make data-driven decisions that improve profitability.

Make good with your time by reviewing your P&L monthly. This simple practice will give you the financial insights needed to grow your business successfully and avoid costly mistakes.

Remember: Revenue is vanity, profit is sanity. Your P&L keeps you focused on what really matters – making money.